![]()

![]()

|

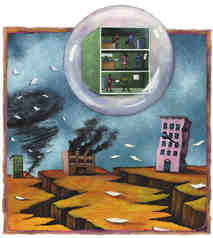

The only reason the business stayed afloat was because its owners had business-interruption insurance, coverage that is commonly overlooked by small business owners when putting together their plans. "In my opinion, business-interruption insurance is one of the most important types of insurance, after property and general liability. It's expensive, but if it's put together properly, it will save your butt," says Michael Smithers, an agent with Sullivan and Curtis Insurance Brokers in Irvine, Calif. "The fact is, without it most businesses that face a catastrophe don't survive." While insurance coverage for floods, fire and disasters is important, and often necessary, it neglects the fact that in the aftermath of a disaster your business must go on --not in a few weeks, not in a few months, but immediately. Such calamity insurance will replace your equipment and your inventory, and help rebuild your building. However, it does not cover employees waiting for paychecks, customers waiting for orders and landlords waiting for the rent --not to mention lost revenues and your own lost income. That's where business-interruption insurance comes in. As early as the day after a disaster has occurred, business-interruption insurance starts providing a business owner with funds to pay salaries, rent and other business bills in the event of fire, vandalism, major equipment breakdown or most other calamities --provided the loss is also covered by property insurance. Business-interruption insurance is always sold as an addition to property-insurance policies and is activated only for the disasters you've covered in that policy. If you have a standard property-insurance policy that excludes floods and earthquakes, for example, business-interruption insurance won't kick in if you're flooded out. SHAKEN UP Laurie Snyder, owner of Flap Happy in Santa Monica, Calif., a manufacturer and distributor of children's hats, clothing and swimwear, admits she was a skeptic. But she investigated business-interruption insurance after the Los Angeles area's powerful 1994 earthquake shook a little sense into her. "It made me take a look at the reality of what could happen," says Snyder, who suffered some damage but not enough to stop production. Although insurance companies consider her business, housed in a brick building built in the 1940s, too much of a risk for earthquake insurance, Snyder now has business-interruption insurance to protect her from other disasters. Her policy will pay up to $325,000 if her business is sidelined by calamity. "It would keep things running status quo if something happens," Snyder says. "If all my fabric and equipment were destroyed, it would allow me to keep my employees so they wouldn't go find other work. If I had to source everything all over again, I'd have a big problem." In 1988, when Bill Ciccone and Ray Lombardi started Eatontown, N.J.-based Scientific Resources Inc., a manufacturer of scientific goods with more than $5 million in revenues, they too followed their agent's advice and purchased business-interruption insurance.

"If we have a fire or flood, our property insurance will reimburse us for the value of the materials lost --the building, the equipment, the inventory," points out Ciccone. "But our business-interruption insurance will give us the ability to get back to business immediately. I believe it's very important to the company." SRI's current insurance agent, William J. Redmond, owner and president of William J. Redmond and Associates Inc., in Freehold, N.J., says the manufacturer's business-interruption insurance would help fill customers' orders right away so they don't go hunting for another supplier. "Business-interruption insurance is disability for a business," Redmond says. Just as disability insurance would pay a person's bills if he or she had an accident or became too ill to work, he explains, business-interruption insurance does the same thing for a business if a covered property disaster occurs. "In Bill [Ciccone's] case, he's got orders to fill. He wants to keep his workers and he wants to keep his customers. The theory behind business-interruption insurance is that your business income should stay as close to normal as possible," Redmond says, adding that the coverage would allow SRI to help fill its customers' orders by using "friendly alliances with competitors." Some businesses, such as manufacturers and distributors with inventory, are obvious candidates for business-interruption insurance. Yet Redmond says just about any business could and should have some business-interruption coverage. "To decide, business owners should ask themselves: If I wasn't able to operate my business for six months to a year, how would I survive?" EXTRA, EXTRA Redmond says business owners also need to consider additional protection known as extra-expense coverage, an add-on to business-interruption insurance. While standard business-interruption insurance will cover lost revenues and continue paying existing bills, extra-expense coverage goes a step further, financing any new costs that crop up as a result of the disaster. For example, if a consultant's office burns down, business-interruption insurance will kick in to pay the rent while the office is being rebuilt or cleaned up. But extra-expense coverage would pay the rent on the temporary office the consultant moves into down the road. Redmond says there is no standard business-interruption policy, and suggests business owners work closely with an insurance agent to craft a policy that works for them. "The first thing a business owner has to do is determine their exposure," says Smithers. "They should ask how long they'd be out of commission in the event of disaster, and get enough coverage to pay their expenses in that time." Smithers says he advises clients to look at business-interruption insurance as part of a disaster plan. Not only should they determine how much time they'd need to get their business back on track, but how they would do so or even if they would do so. "I have a client who admits he wouldn't rebuild, and is insured just enough to cover shut-down costs," he says.

As to how much such coverage will cost your business, agents say prices vary widely from business to business. "Pricing in our business today is all over the place," says Redmond. "It's very much an agent's judgment decision." You can, however, expect the costs of your policy to be based on several factors. First, agents consider the type and size of your business. Is it a consultancy or a fireworks factory? Do you have two employees or 300? Next, agents consider how susceptible your business is to loss. If you have hard-to-replace equipment, as the auto-parts manufacturer did, or if no other business has similar products that could temporarily serve your customers, you can expect your costs to rise. The final determinant is the condition and location of your business. Do you work out of an old building that could be considered a tinderbox, or a new, sprinkler-equipped office. And even if your business isn't a fireworks factory, is it located next to one? Regardless of the specifics of your own situation, experts advise all business owners to take a deep breath and consider what would happen if the worst did happen. If there's a chance your business could sink in the aftermath of a disaster, securing such a policy is more than worth the time and money you would spend on it. "I think people are crazy not to go with business-interruption [coverage]. If you're a manufacturer or a distributor, it's really important,"says Redmond. "If you're a service and you can set up down the street next week, you probably don't need that much. But it's just not an insurance you want to skimp on." |

hen an electrical fire flared at a Northeastern auto-parts manufacturing plant last year, it was quickly doused --but not before damaging some inventory and machinery. Yet the company's owners breathed a sigh of relief, since they had adequate fire insurance coverage and the damage was assessed at a manageable $25,000. Their fire insurance didn't, however, cover the $1.5 million the small company lost in revenue due to the fact that business came to a screeching halt for six months --the time it took to order and install a replacement for a key piece of damaged equipment.

hen an electrical fire flared at a Northeastern auto-parts manufacturing plant last year, it was quickly doused --but not before damaging some inventory and machinery. Yet the company's owners breathed a sigh of relief, since they had adequate fire insurance coverage and the damage was assessed at a manageable $25,000. Their fire insurance didn't, however, cover the $1.5 million the small company lost in revenue due to the fact that business came to a screeching halt for six months --the time it took to order and install a replacement for a key piece of damaged equipment.